Financing Options Every Real Estate Broker Should Know About

Knowing how to finance a real estate brokerage is important for brokers who want to continue growing their business. As a real estate broker increases the number of real estate agents who operate under their umbrella, they will also increase costs.

This isn’t unique to real estate brokerages. Almost without exception, growing your business will your costs to increase. You might require more office space. You may have to spend more on marketing and advertising to take on new business for real estate agents you’ve brought on board. The more listings you have, the more money you spend on marketing those listings and getting them sold, Etc.

One thing that is unique about being a real estate broker is the amount of time you spend waiting to get paid for your work. Most agents perform their work up front and get paid later. It is common to wait thirty days after invoicing a client to get paid. This is normal. But in the real estate business, you may not get paid for your work for a year or more, during which time you are continuously incurring expenses that deplete your cash.

Real Estate Brokers are also unique in that they have more than one “time gap” to finance. For most businesses, once a deal is done, everyone gets paid. But for real estate deals, once a real estate deal is done, it isn’t actually done until the closing meeting when everyone gets paid. So a brokerage might have a listing for months, and then once an agreement is reached, they can wait months more to get paid at closing.

This time gap between paying for expenses and waiting to be paid for services can create cash flow struggles for brokerages. Because of this, it is important for Real Estate Brokers to have access to financing when they need it to continue growing their business, take on new deals, expand into new areas, take market share, and take on new top performing Real Estate Agents for their brokerage.

This article will explain why financing options are important for Real Estate Brokers and explain the differences between some capital finance options for brokers.

What is Cash Flow for Real Estate Brokers

Before we start talking about managing cash flow for Real Estate Brokers, let’s first talk about what cash flow is and why it matters. Cash flow is a word that is thrown around a lot in the business world, but very few people truly understand what it means.

What is Cash Flow?

The first thing to know is that cash flow for Real Estate Brokers is NOT sales. But this is what most people mean when they say the phrase “cash flow.” They are actually talking about sales, and sales is not cash flow.

Not only is cash flow not sales, but an increase in sales also almost always has a negative impact on cash flow.

So what does cash flow for brokers mean? Cash flow describes the flow of cash coming into your business bank and cash flowing out. That is what cash flow is – the flow of money in and out of your business.

The Statement of Cash Flows (if your accountant has prepared one for you) is where you can study the cash flows happening month to month within your business. It documents the cash coming into and leaving the business.

Unfortunately, unless you are an accountant (and even then, most accountants can’t prepare it or read it), this financial statement is hard to understand. So most people, even senior executives in major companies, do not try to read it. They know it exists, but for the most part, it goes ignored.

But you don’t need to be an accountant or finance major to understand cash flow. All you need to know is that cash flow simply means cash flowing in and cash flowing out, and know what constitutes cash from a finance perspective.

What is Cash?

This seems like an obvious question with an even more obvious answer, but it isn’t. Not when it comes to business finance. When most people think of cash, they think of cash in their pocket, or in their savings or checking accounts.

But in business, as it pertains to cash flows, cash in your account is not the only cash to be considered. Cash (as it pertains to finance) does include the cash in your checking or savings accounts, but it doesn’t end there. Cash is ANY money you can spend regardless of where it comes from.

Which means, cash includes any unused but available credit on your credit cards, lines of credit, loans you take out, debt you sell, private equity investment you receive, equipment you sold, and more. Anywhere you can get access to money you are allowed to spend is considered cash with regard to cash flow.

Remember – if you can spend it, it is considered cash for the purpose of discussing cash flow. It doesn’t matter where the money comes from – if you can spend it, it is considered cash.

Cash Flow Management for Real Estate Brokers

Cash flow management is any activity a broker engages in to regulate the amount of cash flowing into the business and the amount of cash flowing out of the business.

In fact, people would probably understand cash flow management better if people called it “cash flow regulation.”

In a perfect cash flow scenario, you would always have cash flowing in faster than it leaves, but in business, especially businesses like real estate, this is rarely the case.

In fact, it is quite the opposite, and this is why it is so difficult to stay in the real estate business – because cash often “flows out” much faster than it “flows in.”

Why do Real Estate Brokers Struggle with Cash Flow?

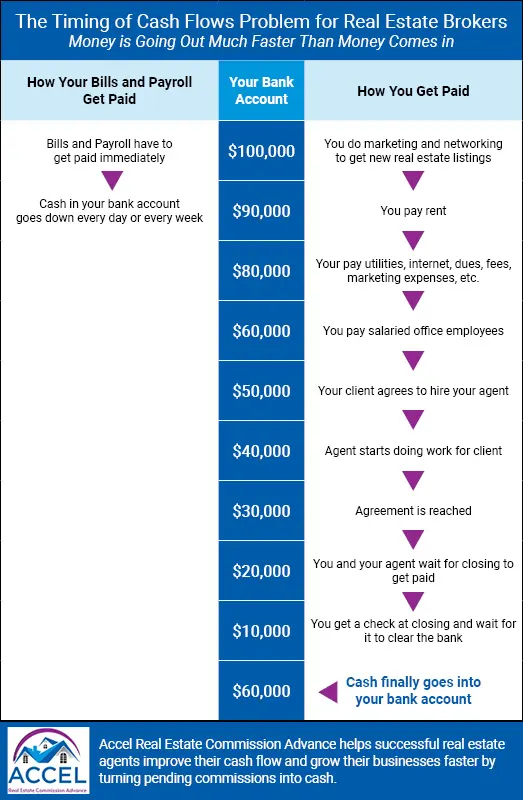

To understand why Real Estate Brokers struggle with cash flow, you need to understand how cash comes into your real estate business, and how it goes out. The main problem Real Estate Brokers have with cash flows is caused by the “timing” of cash coming in versus cash flowing out. (Which is true for lots of different companies).

You have to spend a lot of cash to get listings, have an office, market properties, pay salaried employees, and market your company. The problem is, you are spending all that money every week (or every month) but you don’t get paid every week or every month because it can take a long time to sell a house and even longer to get to the closing meeting where you get paid.

The Timing of Cash Flows Problem for Real Estate Brokers Infographic

This creates a real problem for lots of companies, but Real Estate Brokers are particularly susceptible to cash flow problems because they are expensive to operate, and it often takes a long time to receive your money for your work. Your money is flowing out at more regular intervals than it comes in which leaves the Real Estate Brokers struggling to “finance the wait.”

Problems Lack of Cash Flow Creates For Real Estate Brokers

- Paying Your Bills and Employees – This is the most obvious problem unbalanced cash flow creates for Real Estate Brokers. If you can’t make payroll, you are in trouble. If you can’t pay your bills, your vendors discontinue services, which limits your ability to operate (and damages your company’s credit).

- Growth – The less obvious problem lack of cash flow creates is that it forever limits your growth. Everyone knows you have to spend money to make money – but it’s hard to do if your cash account is empty and you are waiting for multiple closings before you can continue executing your growth strategy.

- Doing it All Yourself – In the short term, if you can’t pay your employees, they will leave, which means whatever they were doing, you now have to do it yourself. And while you are doing that, you are not networking, marketing, doing work you can bill for, or seeking new opportunities for growth. And although this is uncomfortable, lots of small Real Estate Brokers stay stuck in this forever. They always struggle with cash flows and they never grow.

- Long Term Strategy – Businesses with cash flow issues can’t think about long term strategies. They are constantly focused on the moment because they have to chase their next dollar just to keep the doors open.

- Risk Aversion – Business owners who never take risks, never win big. When you have lots of money in the bank (or access to capital), you can take more risks. But when you are low on funds, how much risk are you going to take on new opportunities? How many large opportunities will you miss out on because you simply can’t take the risk, even though it is a pretty good opportunity?

- Marketing – Businesses with cash flow problems don’t spend money on marketing and advertising, which has a way of making sure they stay small. After all, how much marketing are you going to do when you are struggling to make payroll? Probably not much. Marketing is risky – a lot of marketing doesn’t pay off immediately and sometimes doesn’t pay off at all. Real Estate Brokers who struggle with cash flow don’t do much marketing. They can’t afford to take the risk.

- Missed Opportunities on Deals – A company struggling with cash flow imbalance is going to miss out on opportunities. The best deals never wait. You get a call and one shot to get in on a deal, and if you hesitate because your cash flow position is uncertain or precarious, the deal is gone. And not only that, but the people who tend to find and come up with the best real estate deals, eventually figure out that you aren’t playing at their level, and they stop calling you at all when they find a new opportunity because they know you don’t have the cash to get in on it.

Real Estate Brokers Cannot Sustain Growth Without Financing Options

Show me a business that is financing its operations on its own savings account, and I will show you a company that is not positioned well for long term growth. Everybody who has taken a basic business finance course in business college knows this is true. To truly grow a company, you are going to need financing options, and as many financing options as you can find.

Although being debt free and living on your own money (not using financing) might be great on a personal level, it is not a good business goal. Why? Because as a business, you are 100% going to require financing to:

- Invest in New Technology

- Hire Top Talent

- Enter New Markets

- Take Long Term Risks

- Take Market Share from Competitors

- Get Involved in Emerging Real Estate Deals

Why is this the case? Because if you were investing in the latest technology, new talent, and new markets, and taking long term risk to grow, there is no way you will be free of debt (financing), and finance experts know this (unless you had a trust fund or some other windfall in your past). When a finance person finds a business that is not using financing options, they know they’ve found either a takeover target or a weak competitor they can take business away from.

Corporate take-over specialists are always looking for companies with long-term growth potential and no debt (financing). Why are they looking for companies with low or no debt on their balance sheet? Because they know these companies are behind the times and have lots of upside growth potential with the right capital investment.

They buy these companies and borrow against their equity (take on financing for leverage) to finance growth, which increases the value of the company and enhances the investor’s balance sheet, and then they sell them at some point once they have driven up their value.

And when they can’t do that to a company that is debt free (not using financing) – they dismantle these companies and sell them off piece by piece to the highest bidder because with no debts to pay off, when they sell off the property, plant, and equipment it is 100% profit and money in the bank.

Our point in all of this is to make sure you understand that having access to capital financing to grow your Real Estate Brokerage is important unless your goal is to stay small and have a business that just supports your lifestyle but never really goes anywhere.

You see, finance companies know that to truly grow and prosper as a business, you are going to have to use other people’s money. Very few companies have ever found a way around this.

And if you think you know someone who has accomplished successful growth without using financing, chances are, if you knew the truth, there was probably a trust fund or inheritance or someone else backing those companies, which is also not the greatest business plan. Small and medium sized businesses have absolutely decimated an untold number of trust funds, inheritances, 401k’s, and life savings accounts.

And beyond that, if you are a business owner who won’t use financing options to grow your company, but one of your competitors does go out and secures financing to fuel growth, you are going to get left behind. They are going to continue growing, continue taking market share, and continue building their company brand name, and you are going to muddle along and never really go very far as a business. They are simply going to outrun you.

Having Options is Important for Business Finance

There are a lot of financial vehicles available to Real Estate Brokers, and it is important you know what they are and do your best to always have multiple sources of capital financing available to you. You should not trust your future growth to any single source of financing or any single institution (although it is often the case that brokers build relationships with just a few financiers they know and trust, who know and trust them).

Financial vehicles for Real Estate Brokers include loans, lines of credit, bonds, private equity investment, SBA loans, selling equity, business credit cards, and real estate commission advances for brokers, just to name a few.

It is important to know how each of these financing options work, how to gain access to them, and to begin building solid business relationships with the financing firms who offer them. Over time, your best financiers will come to know you well, trust your judgment, and be more and more willing to offer you options for financing your business growth.

Get Started Today – Click Here to Apply Now

Agility and Flexibility in Finance

Agility and flexibility are important when you are considering financing options. If you need to secure a large amount of capital in a short window of time to get in on a real estate deal, you need financing options that are fast and flexible enough to grow with your brokerage.

Banks are some of the most powerful financial institutions in the world and they control a great deal of the wealth in the world today, but they are not generally known for being fast or agile. They tend to be somewhat more risk averse than a private equity investment fund might be (but not always). Banks have lending standards that are precise and specific. They employ processes in their underwriting to help ensure that they don’t make “bad loans.”

All of this can have the effect of making their underwriting less agile. Unfortunately, the best opportunities rarely wait. If a deal is good enough, someone is going to come in with a check and close the deal while you are waiting for someone else to loan you money.

But other investors, like private equity or real estate commission advance companies often have different lending standards than banks, making them faster, and much more flexible. You can often get a real estate commission advance to get some of your capital out of the deal that is just waiting on closing by the day after you file the application.

Savvy real estate brokers will have lots of options for financing operations, including using advances on real estate commissions.

How Real Estate Commission Advances Help with Cash Flow

Remember the basic Real Estate Brokerage cash flow problem? Money goes out fast and comes in slow. One of the ways Real Estate Brokers can manage their cash flow is by using a real estate commission advance company to get their money right away instead of always waiting until closing is complete.

When you or one of your agents sell a home, you are owed your commission. That commission is considered an asset, like a stock or a bond. Because of this, you can “sell” all or a portion of the money that is owed to you to a real estate commission advance company and get your money now, instead of waiting for closing which can be months away.

The way this works is: You sell the commission you are owed for an agreed upon price, and then the real estate commission advance company owns it, and they wait to get paid at closing instead of you. It is as simple as that. You get your money now, and they get paid to do the waiting for you. This way, you are getting cash flowing into your cash account faster, which helps regulate cash flow. Remember, the longer you wait for your money, the more opportunities you will miss.

What Is the Difference Between a Realtor Commission Advance and a Bank Loan?

A real estate commission advance does not in any way resemble a bank loan. A real estate commission advance does not require excellent credit and can be received without having to repay the amount in installments. Furthermore, the fee structure is much different than that of a typical bank loan. Not to mention, a real estate commission advance doesn’t rack up daily, monthly, or yearly interest like other loans do.

In fact, a real estate commission advance is more like selling futures (puts and calls) than it is a loan. You are selling an asset today at a discounted rate, and the people you sell it to get paid an agreed upon amount of money for the asset at some designated date in the future. This does not in any way line up with how a bank loan works.

This distinction might seem like semantics, but the difference between a loan and an advance on real estate commission is such that some states have written laws to specifically declare that these types of transactions in no way meet the threshold to be considered a loan.

Credit Checks Are Not Significant Determining Factors in Commission Advances for Brokers

In the underwriting process for real estate commission advance companies, they do not check your credit score. Real Estate Commission Advance companies do however perform a background check and public records search for liens and judgments against the broker before they enter into an agreement with them.

They do this to make sure they can collect their money at closing and there are no other lien holders who have a priority claim against the commissions they intend to collect at closing; however, your credit score will not stand in the way of you getting approved.

Why Real Estate Commission Advance Instead of a Traditional Line of Credit

We get this question a lot, and there are lots of good reasons to use Real Estate Commission Advances instead of a traditional line of credit.

- Do You Qualify: To get a line of credit, you first must qualify for it, and lines of credit can be some of the most difficult means of financing – especially for new or newer brokerages.

- Inflexibility: A line of credit is fixed, meaning if you have a bunch of new listings come in, you cannot easily just bump up your line of credit to accommodate new business. It is fixed.

- Credit Score: a real estate commission advance is not based on your credit score (although we do a background check and public records search), nor does it impact your credit score because you are not applying for a traditional loan.

- Debt-to-Equity Ratio: The more you borrow, the less you can borrow. This is called your debt-to-equity ratio. The more you borrow, the less the bank will loan you in the future. A real estate commission advance for brokers does not show up on your credit report, so it doesn’t impact your debt-to-equity ratio.

- Variable Cost: Unlike a loan that has to be paid back every month (which reduces cash in the bank), you don’t pay back your real estate commission advance. The real estate commission advance company gets paid at closing. And it is truly a variable cost because you are only using your real estate commission advance when you have deals closing.

Why do Real Estate Brokers Use Commission Advances?

Commission advances are funds provided by a commission advance company to the broker before the sale of a property is completed. Real Estate Brokers often use commission advances as a finance option to free up working capital. These funds can be used to cover marketing costs, legal fees, and other expenses associated with closing real estate deals.

The commission advance for the broker’s company then collects their repayment plus interest when the transaction is finalized.

One of the biggest advantages of using a commission advance for Real Estate Brokers is the ability to access funds quickly. Instead of waiting weeks or even months to receive your commissions, you can get some of your money in just one day. This can give brokers the peace of mind of knowing that they have cash available to cover unexpected expenses or reinvest in their business.

Another benefit is the flexibility in repayment terms. Unlike a traditional loan, commission advances are typically structured as a percentage-based repayment plan that allows you to only repay a portion of your commissions each time you receive a paycheck. This means that if your commissions decrease or stop altogether, you won’t be left with unmanageable debt.

Finally, commission advances can help brokers increase their profits by allowing them to reinvest in their business sooner. With access to cash upfront, brokers can take advantage of opportunities such as marketing campaigns, hiring staff, or even increasing their inventory. This can give them a competitive edge in their market and help them generate more revenue over the long run.

Now that you understand the potential benefits of commission advances for Real Estate Brokers, let’s look at what to look for when choosing a provider.

What to Look for in Providers of Real Estate Commission Advances For Brokers

When choosing a commission advance provider, it’s important to do your research and make sure the company is reputable. Look for providers that have been in business for several years and have an established track record of success with Real Estate Brokers. You should also inquire about their customer service policies – make sure they offer prompt responses to any questions or concerns you may have.

Some other things to look for when choosing a provider include the repayment terms, fees charged, and the amount of funds that can be advanced. Most providers offer flexible repayment terms so make sure to understand how much you will need to pay each time you receive a commission check. Additionally, some providers may charge additional fees so make sure you understand your contract completely and ask as many clarification questions as necessary to make sure you are clear about every aspect of the advance you are taking out.

Finally, find out how much money you can access – it’s important to ensure that the provider can offer sufficient funds for your needs.

Lastly, keep track of all payments and statements so that you are aware of the total amount remaining on the loan. With proper planning and careful management, commission advances can be a beneficial tool for Real Estate Brokers to maximize their profits.

The Real Estate Commission Advance for Brokers Process

The process of obtaining a real estate commission advance is relatively straightforward. The first step is to identify a reputable real estate commission advance company that offers services for real estate brokers. You can find real estate commission advance companies online or through referrals from other real estate professionals. Once you’ve identified a suitable provider, it’s time to apply for the advance.

When applying for a commission advance, you’ll typically need to provide information including the number of closed transactions in which you received commissions in the last 12 months, copies of your real estate license and E&O insurance, and bank account statements. The provider will then review your application and determine if they can offer an advance.

Once your application has been approved, you’ll be able to receive the advance quickly and easily. Most providers will deposit the funds into your bank account within 48 hours of approval and some can even offer same-day funding. The repayment process is equally simple – typically, providers will deduct a fixed percentage of each commission check that you receive until the loan is fully repaid.

Summary – How to Finance Your Real Estate Brokerage

Real Estate Brokers who are interested in long term growth must have capital financing available to them at all times to manage cash flow, finance operations, market successfully, take on new talent, take short- and long-term risks, and get involved in the best real estate deals.

It is important for real estate brokers to not be over-reliant upon one source of capital financing. Although you will develop significant relationships with financing companies over time, it is important to have options available including:

- Bank Loans

- Lines of Credit

- Private Equity Investment

- Selling Equity

- Business Credit Cards

- Real Estate Commission Advances

- SBA Loans

- And more!

Real Estate Brokers who are serious about growth understand they cannot finance their future growth based on their own cash flows. Large businesses never attempt this. They use every financial vehicle available to them to keep adding to their talent, invest in technology, take market share, and absorb other companies and businesses.

Without financing options, you will not be able to market properly, you will not be able to take risks, and you will not be able to focus at all on long term strategic initiatives. Let’s face it when you are struggling to make payroll and pay the rent, you aren’t going to be thinking about your next strategic marketing initiative, and you certainly aren’t going to be thinking about three to five years down the road.

So, start learning about and finding capital finance options for your real estate brokerage now. Learn about how they work, and who they are, and start building long term relationships with these financiers, because the day will most likely come when you will need the trust and goodwill of strong relationships you’ve built to capitalize on a deal that will forever change the future of your brokerage; and you can bet it will be an opportunity that will come and go quickly if you fail to act because you lack capital financing.

Get Started Today – Click Here to Apply Now

About Real Estate Commission Advances For Brokers – from Accel Real Estate Commission Advance

Accel Real Estate Commission Advance provides flexible financial options to help real estate professionals meet their cash flow needs.

Our priority is to see your real estate business grow by advancing the capital you need when you need it. We are wholeheartedly committed to identifying and meeting the needs of our clients, by developing financial products that not only meet but exceed their expectations.

Frequently Asked Questions About Commission Advance for Brokers

What are the requirements for taking out a real estate commission advance for brokers?

Brokers need to have been a sponsoring broker for at least 12 months and have at least 5 agents on their team (these are the minimum requirements)

What percentage per deal will you fund?

For their first advance with us, brokers can fund up to $5,000. Brokers can fund up to 60% of their commission after they have established a relationship with Accel Advance.

Is there a maximum number of advances they can have out?

There is no maximum number but the maximum amount is $5,000 for first time clients, and for clients who have an established relationship the maximum is $15,000 for brokers (this can be from one advance or across multiple advances pending they’ve met all other qualifications for funding on any additional advances)

What information does a real estate broker need to provide you with (if different than a real estate agent commission advance)?

Production history for the broker and the brokerage and information on additional pending properties or exclusive listings for both the broker independently and the brokerage (in some cases).

To get started today, email Amy Redcloud at aredcloud@acceladvance.com or give us a call at 267-769-0747.